Welcome to our knowledge center

We are in the business of Risk Management Solutions for banks for over 15 years and experts in trade, commodities and asset management. We are pleased to share our knowledge with subject matter experts in the field.

Compliant risk and exposure managment

Compliant risk and exposure managment

Compliant risk and exposure managment

We support banks in their balance sheet reporting tasks according to the Basel regulations and IFRS standards.

We support banks in their balance sheet reporting tasks according to the Basel regulations and IFRS standards.

We support banks in their balance sheet reporting tasks according to the Basel regulations and IFRS standards.

Accurate valuation of collateralised assets.

Accurate valuation of collateralised assets.

Risk reporting on each asset class consistent with IFRS rules.

Risk reporting on each asset class consistent with IFRS rules.

"What-if" scenarios for collateral exposure management.

"What-if" scenarios for collateral exposure management.

Accurate valuation of collateralised assets.

Risk reporting on each asset class consistent with IFRS rules.

"What-if" scenarios for collateral exposure management.

Accurate valuation of collateralised assets.

Risk reporting on each asset class consistent with IFRS rules.

"What-if" scenarios for collateral exposure management.

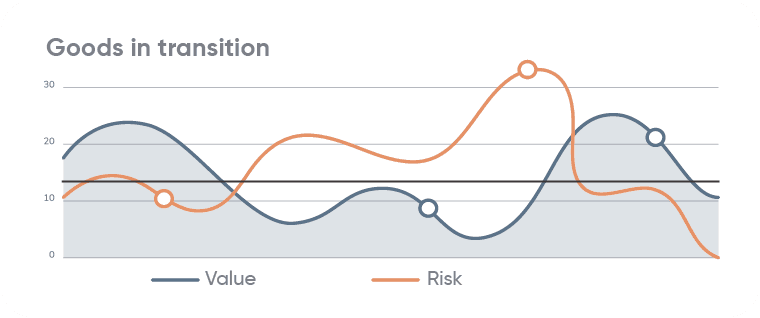

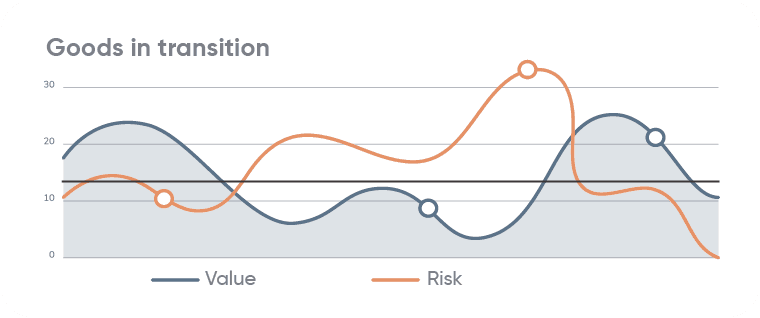

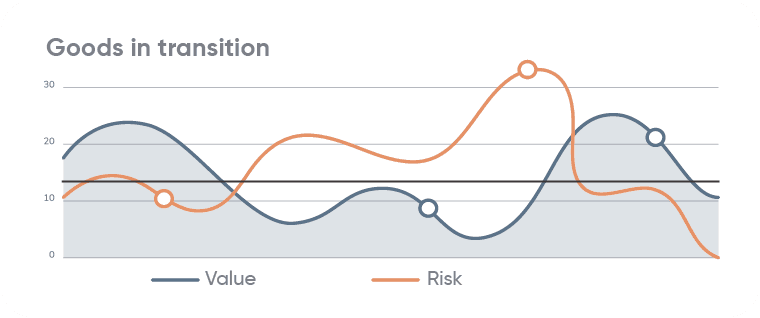

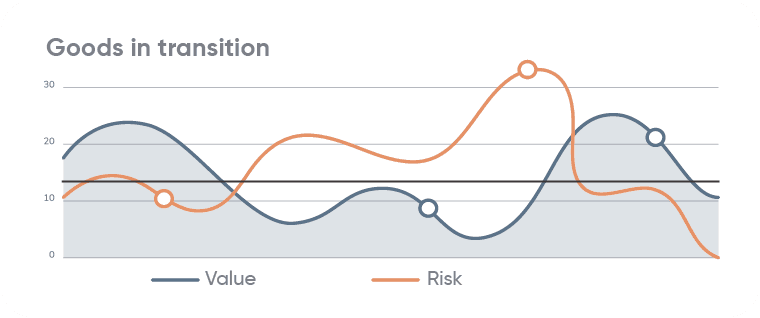

Goods in transition

Goods in transition

Goods in transition

Our collateral management solutions cover goods in transit, allowing you to monitor collateral values from production to sale.

Our collateral management solutions cover goods in transit, allowing you to monitor collateral values from production to sale.

Our collateral management solutions cover goods in transit, allowing you to monitor collateral values from production to sale.

Management of values throughout the supply chain.

Management of values throughout the supply chain.

Limits on percentage values in transit.

Limits on percentage values in transit.

Registration of estimated arrival times.

Registration of estimated arrival times.

Alerts on limit breaks and delays.

Alerts on limit breaks and delays.

Management of values throughout the supply chain.

Limits on percentage values in transit.

Registration of estimated arrival times.

Alerts on limit breaks and delays.

Management of values throughout the supply chain.

Limits on percentage values in transit.

Registration of estimated arrival times.

Alerts on limit breaks and delays.

Carbon neutrality

Carbon neutrality

Carbon neutrality

Banks need to understand and report on their financed emissions, including those for Trade Finance and Asset Based lending. Carbon intensity has become part of the risk profile of borrowers and needs to be incorporated in pricing. Carbon removal projects offer new financing opportunities for banks.

Banks need to understand and report on their financed emissions, including those for Trade Finance and Asset Based lending. Carbon intensity has become part of the risk profile of borrowers and needs to be incorporated in pricing. Carbon removal projects offer new financing opportunities for banks.

Banks need to understand and report on their financed emissions, including those for Trade Finance and Asset Based lending. Carbon intensity has become part of the risk profile of borrowers and needs to be incorporated in pricing. Carbon removal projects offer new financing opportunities for banks.

Carbon accounting for Trade Finance and Asset Based lending.

Carbon accounting for Trade Finance and Asset Based lending.

Incorporating carbon premium in facility pricing and risk management.

Incorporating carbon premium in facility pricing and risk management.

Carbon intensity at facility level including carbon credits allocated as hedges.

Carbon intensity at facility level including carbon credits allocated as hedges.

Carbon accounting for Trade Finance and Asset Based lending.

Incorporating carbon premium in facility pricing and risk management.

Carbon intensity at facility level including carbon credits allocated as hedges.

Carbon accounting for Trade Finance and Asset Based lending.

Incorporating carbon premium in facility pricing and risk management.

Carbon intensity at facility level including carbon credits allocated as hedges.

Stay up to date

Stay Informed with the Latest Insights and Trends

Together with our global clients, we are managing a significant part of Global Trade Finance. We publish regularly white papers about latest trends, insights and best practices. Stay tuned, and register for our publications.

Stay up to date

Stay Informed with the Latest Insights and Trends

Together with our global clients, we are managing a significant part of Global Trade Finance. We publish regularly white papers about latest trends, insights and best practices. Stay tuned, and register for our publications.

Stay up to date

Stay Informed with the Latest Insights and Trends

Together with our global clients, we are managing a significant part of Global Trade Finance. We publish regularly white papers about latest trends, insights and best practices. Stay tuned, and register for our publications.

Stay up to date

Stay Informed with the Latest Insights and Trends

Together with our global clients, we are managing a significant part of Global Trade Finance. We publish regularly white papers about latest trends, insights and best practices. Stay tuned, and register for our publications.

Current Thought Leadership and Insights

Current Thought Leadership and Insights

Utilizing Carbon Removal Certificates as collateral.

Utilizing Carbon Removal Certificates as collateral.

Utilizing Carbon Removal Certificates as collateral.

Share Your Collateral Management Challenges

Share Your Collateral Management Challenges

Share Your Collateral Management Challenges

Embracing Automation in Trade and Commodity Finance

Embracing Automation in Trade and Commodity Finance

Embracing Automation in Trade and Commodity Finance

Blueprints of Innovation – Triquesta Whitepapers

Blueprints of Innovation – Triquesta Whitepapers

Net Zero: Funding the Transition

Discover how your Bank can include Carbon emissions in its lending activities.

Transforming Risk Management in Trade Finance

Discover how innovative technology is reshaping risk management in global trade.

Streamlining Warehouse Operations with Tech

Explore how advanced solutions are optimizing warehouse management and risk assessment.

Net Zero: Funding the Transition

Discover how your Bank can include Carbon emissions in its lending activities.

Transforming Risk Management in Trade Finance

Discover how innovative technology is reshaping risk management in global trade.

Streamlining Warehouse Operations with Tech

Explore how advanced solutions are optimizing warehouse management and risk assessment.

Net Zero: Funding the Transition

Discover how your Bank can include Carbon emissions in its lending activities.

Transforming Risk Management in Trade Finance

Discover how innovative technology is reshaping risk management in global trade.

Streamlining Warehouse Operations with Tech

Explore how advanced solutions are optimizing warehouse management and risk assessment.

Net Zero: Funding the Transition

Discover how your Bank can include Carbon emissions in its lending activities.

Transforming Risk Management in Trade Finance

Discover how innovative technology is reshaping risk management in global trade.

Streamlining Warehouse Operations with Tech

Explore how advanced solutions are optimizing warehouse management and risk assessment.

What our clients say

We can now even accept CO2 certificates as collateral in structured deals.

What our clients say

Fully reflects the impact of CO2 emissions on our lending activities.

What our clients say

We fully integrated Vessel tracking and ETA services.

What our clients say

Great! Sanction checking at Transaction level.

What our clients say

Supports me as Transaction manager around the clock.

What our clients say

Configurable to meet every collateralized asset deal

What our clients say

We can now even accept CO2 certificates as collateral in structured deals.

What our clients say

Fully reflects the impact of CO2 emissions on our lending activities.

What our clients say

We fully integrated Vessel tracking and ETA services.

What our clients say

Great! Sanction checking at Transaction level.

What our clients say

Supports me as Transaction manager around the clock.

What our clients say

Configurable to meet every collateralized asset deal

What our clients say

We can now even accept CO2 certificates as collateral in structured deals.

What our clients say

Fully reflects the impact of CO2 emissions on our lending activities.

What our clients say

We fully integrated Vessel tracking and ETA services.

What our clients say

Great! Sanction checking at Transaction level.

What our clients say

Supports me as Transaction manager around the clock.

What our clients say

Configurable to meet every collateralized asset deal

What our clients say

We can now even accept CO2 certificates as collateral in structured deals.

What our clients say

Fully reflects the impact of CO2 emissions on our lending activities.

What our clients say

We fully integrated Vessel tracking and ETA services.

What our clients say

Great! Sanction checking at Transaction level.

What our clients say

Supports me as Transaction manager around the clock.

What our clients say

Configurable to meet every collateralized asset deal

What our clients say

We can now even accept CO2 certificates as collateral in structured deals.

What our clients say

Fully reflects the impact of CO2 emissions on our lending activities.

What our clients say

We fully integrated Vessel tracking and ETA services.

What our clients say

Great! Sanction checking at Transaction level.

What our clients say

Supports me as Transaction manager around the clock.

What our clients say

Configurable to meet every collateralized asset deal

What our clients say

We can now even accept CO2 certificates as collateral in structured deals.

What our clients say

Fully reflects the impact of CO2 emissions on our lending activities.

What our clients say

We fully integrated Vessel tracking and ETA services.

What our clients say

Great! Sanction checking at Transaction level.

What our clients say

Supports me as Transaction manager around the clock.

What our clients say

Configurable to meet every collateralized asset deal

What our clients say

We can now even accept CO2 certificates as collateral in structured deals.

What our clients say

Fully reflects the impact of CO2 emissions on our lending activities.

What our clients say

We fully integrated Vessel tracking and ETA services.

What our clients say

Great! Sanction checking at Transaction level.

What our clients say

Supports me as Transaction manager around the clock.

What our clients say

Configurable to meet every collateralized asset deal

What our clients say

We can now even accept CO2 certificates as collateral in structured deals.

What our clients say

Fully reflects the impact of CO2 emissions on our lending activities.

What our clients say

We fully integrated Vessel tracking and ETA services.

What our clients say

Great! Sanction checking at Transaction level.

What our clients say

Supports me as Transaction manager around the clock.

What our clients say

Configurable to meet every collateralized asset deal

What our clients say

We can now even accept CO2 certificates as collateral in structured deals.

What our clients say

Fully reflects the impact of CO2 emissions on our lending activities.

What our clients say

We fully integrated Vessel tracking and ETA services.

What our clients say

Great! Sanction checking at Transaction level.

What our clients say

Supports me as Transaction manager around the clock.

What our clients say

Configurable to meet every collateralized asset deal

What our clients say

We can now even accept CO2 certificates as collateral in structured deals.

What our clients say

Fully reflects the impact of CO2 emissions on our lending activities.

What our clients say

We fully integrated Vessel tracking and ETA services.

What our clients say

Great! Sanction checking at Transaction level.

What our clients say

Supports me as Transaction manager around the clock.

What our clients say

Configurable to meet every collateralized asset deal

What our clients say

We can now even accept CO2 certificates as collateral in structured deals.

What our clients say

Fully reflects the impact of CO2 emissions on our lending activities.

What our clients say

We fully integrated Vessel tracking and ETA services.

What our clients say

Great! Sanction checking at Transaction level.

What our clients say

Supports me as Transaction manager around the clock.

What our clients say

Configurable to meet every collateralized asset deal

What our clients say

We can now even accept CO2 certificates as collateral in structured deals.

What our clients say

Fully reflects the impact of CO2 emissions on our lending activities.

What our clients say

We fully integrated Vessel tracking and ETA services.

What our clients say

Great! Sanction checking at Transaction level.

What our clients say

Supports me as Transaction manager around the clock.

What our clients say

Configurable to meet every collateralized asset deal

What our clients say

We can now even accept CO2 certificates as collateral in structured deals.

What our clients say

Fully reflects the impact of CO2 emissions on our lending activities.

What our clients say

We fully integrated Vessel tracking and ETA services.

What our clients say

Great! Sanction checking at Transaction level.

What our clients say

Supports me as Transaction manager around the clock.

What our clients say

Configurable to meet every collateralized asset deal

What our clients say

We can now even accept CO2 certificates as collateral in structured deals.

What our clients say

Fully reflects the impact of CO2 emissions on our lending activities.

What our clients say

We fully integrated Vessel tracking and ETA services.

What our clients say

Great! Sanction checking at Transaction level.

What our clients say

Supports me as Transaction manager around the clock.

What our clients say

Configurable to meet every collateralized asset deal

What our clients say

We can now even accept CO2 certificates as collateral in structured deals.

What our clients say

Fully reflects the impact of CO2 emissions on our lending activities.

What our clients say

We fully integrated Vessel tracking and ETA services.

What our clients say

Great! Sanction checking at Transaction level.

What our clients say

Supports me as Transaction manager around the clock.

What our clients say

Configurable to meet every collateralized asset deal

What our clients say

We can now even accept CO2 certificates as collateral in structured deals.

What our clients say

Fully reflects the impact of CO2 emissions on our lending activities.

What our clients say

We fully integrated Vessel tracking and ETA services.

What our clients say

Great! Sanction checking at Transaction level.

What our clients say

Supports me as Transaction manager around the clock.

What our clients say

Configurable to meet every collateralized asset deal

Contact us

Ready to Transform Your Financial Operations?

Leave your details with us, and we'll reach out to show you how Triquesta can help your business thrive in today's dynamic financial landscape.

Contact us

Ready to Transform Your Financial Operations?

Leave your details with us, and we'll reach out to show you how Triquesta can help your business thrive in today's dynamic financial landscape.

Contact us

Ready to Transform Your Financial Operations?

Leave your details with us, and we'll reach out to show you how Triquesta can help your business thrive in today's dynamic financial landscape.

Contact us

Ready to Transform Your Financial Operations?

Leave your details with us, and we'll reach out to show you how Triquesta can help your business thrive in today's dynamic financial landscape.